IN THE HIGH COURT OF THE WESTERN PROVINCE

SITTING IN COLOMBO

IN THE EXERCISE OF ITS CIVIL JURISDICTION

YCC EXPORTERS LIMITED

No. 133/8, Gothami Road

Rajagiriya

CLAIMANT

Vs.

DELMEGE DISTRIBUTORS (PVT) LTD.

No. 101, Vinayalankara Mawatha

Colombo 10.

RESPONDENT

AND NOW

In the matter of an Application to set aside Arbitral Awards in terms of Section 32 of the Arbitration Act No. 11 of 1995

DELMEGE FORSYTH & CO. LTD., with which Company DELMEGE DISTRIBUTORS (PVT) LTD., is now amalgamated with,

and of No. 101, Vinayalankara Mawatha

Colombo 10.

RESPONDENT-PETITIONER

H.C. (Civil) WP Case No. 64/2013/ARB Vs.

YCC EXPORTERS LIMITED

No. 133/8, Gothami Road

Rajagiriya

CLAIMANT-RESPONDENT

On this 5th day of April 2013

The Petition of the Respondent-Petitioner abovenamed appearing by Yamuna Balasuriya, Attorney-at-Law, practising under the name, style and firm of V. W. Kularatne Associates and her Professional Assistant, Vijayalakshmi Deepani Niroshini Wijesekera, its Attorneys-at-Law, states as follows:

1. The Respondent-Petitioner abovenamed (hereinafter sometimes referred to as the “Petitioner”) was a Company duly incorporated under the laws of Sri Lanka and has its Office at the aforementioned address, and on 13th June 2012 the Delmege Distributors (Pvt) Ltd., the Respondent in the Arbitration referred to herein was amalgamated with Delmege Forsyth & Co. Ltd., at the same aforesaid address, within the jurisdiction of Your Honour’s Court. The management control and majority Shareholdings of Delmege Forsyth & Co. Ltd. changed in or about June 2011.

A true copy of the Certificate of Amalgamation issued by the Registrar General of Companies dated 13th June 2012 is annexed hereto marked “P1”, pleaded as part and parcel hereof

2. The Claimant-Respondent abovenamed (hereinafter sometimes referred to as the “Respondent”) is a Company duly incorporated under the laws of Sri Lanka and has its Office at the aforementioned address, within the jurisdiction of Your Honour’s Court.

3. On or about 10th May 2007 a Memorandum of Understanding was entered into between the Respondent and the Petitioner, and in pursuant thereto on or about 28th May 2007 an Agreement was entered into between the Respondent and the Petitioner.

True copies of the said Memorandum of Understanding dated 10th May 2007 and the said Agreement dated 28th May 2007 are annexed hereto marked “P2” and “P3”, respectively, pleaded as part and parcel hereof

4.

(a) Under and in terms of the aforesaid Memorandum of Understanding [P2] and Agreement [P3] the Petitioner advanced to the Respondent a Loan of Rs. 20 Mn., of which Rs. 2 Mn., was advanced on 11th May 2007 upon the execution of the Memorandum of Understanding [P2], and the balance Rs. 18 Mn., was advanced on 28th May 2007 upon the execution of the said Agreement [P3], and the Respondent signed a Promissory Note dated 28th May 2007 promising to pay on demand the said Rs. 20 Mn., to the Petitioner.

A true copy of the said Promissory Note dated 28th May 2007 is annexed hereto marked “P4”, pleaded as part and parcel hereof

(b) It is evident that the Petitioner had advanced by way of Loans a substantial sum of Rs. 20 Mn., as had been required by the Respondent, obviously in circumstances of financial predicament, which the Respondent had been in.

5. Under and in terms of the said Memorandum of Understanding [P2] and Agreement [P3] –

(a) The Respondent appointed the Petitioner as the exclusive Licensee and Distributor of the products under the “Doctor Baby” Brand Name, claimed to have been owned by the Respondent.

(b) For the aforesaid Brand Name, the Petitioner was to pay to the Respondent a Royalty Fee of Rupees One Million Five Hundred Thousand (Rs. 1,500,000/-) per month or Ten Percent (10%) of the Net Sales Price, whichever is higher, in respect of each Month.

(c) The aforesaid Royalty Fee payable per Month was to be set-off as part repayments of the aforesaid Loan of Rupees Twenty Million (Rs. 20 Mn.) with interest thereon calculated at the market rate of interest to be determined by the Bank of the Petitioner being applied on the diminishing balance, after the recoupment of the Monthly Royalty Fee.

6.

(a) In terms of Clause 3(1) of the aforesaid Agreement [P3], the aforesaid Loan was to be re-paid with interest thereon calculated at the market rate of interest to be determined by the Bank of the Petitioner, which rate of interest had been confirmed to be 19% p.a., as evidenced by the confirmation Statement dated 29th February 2008 of the Respondent [P5].

(b) The said confirmation dated 29th February 2008 of the Respondent [P5] further confirmed the debt of Rs. 24,111,947/- as at 29th February 2008 by the Respondent to the Petitioner, with no debt, whatsoever, due to the Respondent from the Petitioner as at that date 29th February 2008.

A true copy of the said confirmation Statement dated 29th February 2008 is annexed hereto marked “P5”, pleaded as part and parcel hereof

7.

(a) Though the Agreement [P3] was entered into on 28th May 2007, due to practicalities, the actual operations of the arrangements contemplated under the said Agreement [P3] had not immediately commenced, and had commenced only subsequently.

(b) Among the reasons for the frustration of such commencement of operations immediately after entering into Agreement [P3] on 28th May 2007, had been;

(i) the inability on the part of the Respondent to have readily made available the products for distribution and sales by the Petitioner, inter-alia, due to the default of payments by them to their respective Suppliers of the products, and

(ii) also due to the absence of the requisite approvals therefor, which had to be obtained and provided by the Respondent from the Cosmetics, Devices & Drugs Regulatory Authority.

8.

(a) In such circumstances, as had been requested by the Respondent, the following further Loan Advances had been made by the Petitioner to the Respondent;

10th December 2007 – Rs. 1,500,000/-

26th March 2008 – Rs. 1,700,000/-

25th June 2008 – Rs. 750,000/-

Rs. 3,950,000/-

(b) The Statement [P5] dated 29th February 2008 given by the Respondent had confirmed that the Respondent owed the Petitioner Rs. 24,411,947/- as at 29th February 2008, having acknowledged the payment of Rs. 1,500,000/- on 10th December 2007, then described as Royalty, that too, only in the Month of December 2007, and not before; but later acknowledged by the Respondent on 25th June 2008 vide [P6] as a Loan as referred to at 8(a) hereinabove.

(c) Consequently in such circumstances, the Petitioner and Respondent by Letter dated 25th June 2008 [P6] had further jointly agreed as follows;

(i) for the Petitioner to make a minimum Royalty payment of Rs. 700,000/- per Month to the Respondent, until 10% of the actual Sales exceeded Rs. 700,000/- per Month, without making any recoupment from the aforesaid Loans.

(ii) that the Petitioner would recover from the Respondent monies on the aforesaid Loans of Rs. 20,000,000/- and Rs. 3,950,000/- , including the aforesaid payment made in December 2007, which had previously been described as Royalty and later treated as a Loan as aforesaid, from Royalties in excess of Rs. 700,000/- per Month.

(iii) that a total of Rs. 8,739,251/- (i.e. Rs. 206,137/- + Rs. 4,199,781/- + Rs. 4,333,333/-) was due to the Petitioner from the Respondent as at 30th June 2008, in addition to the aforesaid Loans of Rs. 23,950,000/-, and that nothing was due to the Respondent from the Petitioner as at 30th June 2008.

(iv) the said Letter dated 25th June 2008 [P6] jointly signed by the Petitioner and Respondent constituted an amendment to the Agreement [P3] dated 28th May 2007.

(v) accordingly the minimum Royalty payable of Rs. 1,500,000/- per Month as per Agreement [P3] dated 28th May 2007 had been abandoned by the aforesaid joint Letter dated 25th June 2008 [P6] stipulating a new minimum Royalty of Rs. 700,000/- per Month to be paid by the Petitioner to the Respondent, without any recoupment against the aforesaid Loans, and anything in excess of Rs, 700,000/- per Month up to 10%, as Royalty on the total sales, to be recouped as re-payments against the aforesaid Loans to the Petitioner.

A true copy of the said Letter dated 25th June 2008 is annexed hereto marked “P6”, pleaded as part and parcel hereof

(d) It is evident from the foregoing that the then prevalent Sales of the said “Doctor Baby” products of the Respondent had not been adequate enough to recoup the aforesaid Loans advanced by the Petitioner to the Respondent, as had been required by the Respondent to be recouped from the aforesaid future Royalties on the said Sales of the said “Doctor Baby” products of the Respondent, as had been contemplated in the Agreement [P3].

9.

(a) Thereafter several disputes had arisen between the Petitioner and the Respondent, resulting in the Petitioner terminating the aforesaid Agreement [P3], read together with joint Letter dated 25th June 2010 [P6], with effect from 30th June 2010 by the Petitioner’s Letter dated 31st March 2010 [P7], in terms of Clause 6(6) of the said Agreement [P3].

(b) The said termination of the Agreement [P3], read together with joint Letter dated 25th June 2010 [P6], being within a period of 5 years from the date of the said Agreement [P3] dated 28th May 2007, the following proviso of Clause 6(6) of the said Agreement [P3] came into force and operation;

“Provided if the Agreement is so terminated before the expiry of a period of Five years from the date hereof YCC shall refund all monies remaining in its hands out of the said sum of Rs.20,000,000/- to Delmege.”

(c) The said Agreement [P3] dated 28th May 2007 contained the following Clause 6(6):

“6(6) Delmege shall as any time during the currency of this Agreement have the right of terminating this Agreement by giving YCC Ninety (90) days written notice of such termination and upon termination or sooner determination of this Agreement, Delmege shall immediately cease the use of the Brand Name, unless it has purchased the same hereunder from YCC.

Provided if the Agreement is so terminated before the expiry of a period of Five years from the date hereof YCC shall refund all monies remaining in its hands out of the said sum of Rs.20,000,000/- to Delmege.” (Emphasis added)

(d) Thus, under and in terms of the said Clause 6(6), the Petitioner terminated the said Agreement [P3] dated 28th May 2007, read together with joint Letter dated 25th June 2010 [P6], with effect from 30th June 2010 i.e. after the effluxion of a period of 3 years and one month, which was before the expiry of a period of 5 years from the date of said Agreement [P3], whereupon the aforesaid proviso in Clause 6(6) came into force and operation.

A true copy of the Petitioner’s Letter dated 31st March 2010 terminating the said Agreement is annexed hereto marked “P7”, pleaded as part and parcel hereof

10. The said Agreement [P3] dated 28th May 2007 contained the following further Clauses:

(a) Clause 4(2)

“At the termination of this Agreement by efflux of time or the sooner determination thereof;

(a) any Royalty Fee remaining unsettled as aforesaid shall be paid and settled by Delmege to and on demand by YCC; and

(b) any, Royalty Fee paid in excess of the required amount remaining with YCC shall be refunded by YCC to Delmege on demand together with the aforesaid interest thereon; “

(b) Clause 4(4)

“At the termination this Agreement by efflux of time or the sooner determination thereof, Delmege may put the said Promissory Note in suit to recover any sums of money from and out of the Upfront Payment remaining unpaid by YCC hereunder and, if all such monies due have been paid and settled by YCC, then the said Promissory Note shall be returned to YCC by Delmege.”

(c) Clause 7(5)

“The termination of this Agreement by afflux of time or the sooner determination thereof as aforesaid shall not affect the rights of either of the parties hereto from claiming and recovering from the other of them all dues and properties that may have become payable or recoverable by the date of each termination or sooner determination. “

11. (a) Nevertheless, by Letter dated 10th June 2010, the Respondent, acting through Mahinda Ellepola, Attorney-at-Law, referred the matter for Arbitration, nominating Dudley A. Karunaratne, Retired High Court Judge, as the Sole Arbitrator, and giving 30 day’s notice to the Petitioner to nominate the Petitioner’s Arbitrator, if the Petitioner does not agree to a Sole Arbitrator.

eto marked “P8”, pleaded as part and parcel hereof

(b) Consequently, the Petitioner sent Letter of Demand dated 2nd July 2010 to the Respondent, claiming a sum of Rs. 24,045,280/44 from the Respondent.

A true copy of the said Letter of Demand dated 2nd July 2010 is annexed hereto marked “P9”, pleaded as part and parcel hereof

(c) Thereafter, the Petitioner by Letter dated 8th July 2010 addressed to the aforesaid Mahinda Ellepola, Attorney-at-Law for the Respondent, denied the allegations in the aforesaid Letter dated 10th June 2010 [P8] of the said Attorney-at-Law, as baseless and malicious, and stated that the Respondent had failed to duly comply with its obligations under the said Agreement [P3)], and reiterated its demand for the payment by the Respondent of Rs. 24,045,280/44 made by the aforesaid Letter of Demand dated 2nd July 2010 [P9], and subject thereto, nominated Kushan D’ Alwis, Attorney-at-Law, as the Petitioner’s Arbitrator.

A true copy of the said Letter dated 8th July 2010 is annexed hereto marked “P10”, pleaded as part and parcel hereof

12.

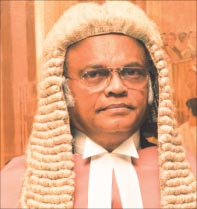

(a) Consequently, in terms of Section 6(3) of the Arbitration Act No. 11 of 1995, the retired Supreme Court Judge, D.J. de Silva Balapatabendi had been appointed, as an additional Arbitrator to act as the Chairman of the Arbitral Tribunal, as evidenced by Letter dated 4th August 2010 received from the Sri Lanka National Arbitration Centre.

A true copy of the said Letter dated 4th August 2010 is annexed hereto marked “P11”, pleaded as part and parcel hereof

(b) Accordingly, Arbitral Proceedings commenced at the Sri Lanka National Arbitration Centre, Colombo 2, within the jurisdiction of Your Honour’s Court.

(c) As at the date of the aforesaid appointment, as the Chairman Arbitrator, D.J. de Silva Balapatabendi had retired on or about 17th May 2010, as a Supreme Court Judge.

(d) Subsequently however, the said D.J. de Silva Balapatabendi had been appointed on or about 13th May 2011, as a Member of the Commission to Investigate Allegations of Bribery or Corruption in terms of Act No. 19 of 1994, and had been appointed as Chairman of the said Commission.

(e) In terms of Section 18 of the Commission to Investigate Allegations of Bribery or Corruption Act No. 19 of 1994, the said Chairman of the Commission, D.J. de Silva Balapatabendi was deemed to be a ‘public servant’, within the meaning of the Penal Code, which at Section 19 thereof defined a ‘public servant’.

13. (a) The Petitioner is advised that in the foregoing circumstances, the said Chairman of the Arbitral Tribunal, D.J. de Silva Balapatabendi having assumed Office, as the Chairman and Commission Member of the Commission to Investigate Allegations of Bribery or Corruption, became a ‘public servant’, as aforesaid, exercising executive and quasi-judicial power, and was thus and thereby ipso facto disqualified from functioning, as Chairman of a private Arbitral Tribunal, involving commercial disputes between private parties, and receiving payments therefor from the private parties.

(b) Unlike other ‘public servants’, Supreme Court Judges in Sri Lanka retire at the age of 65 years with 90% of the salary, allowances and other perquisites, so that such persons are not compelled to seek post retirement employment.

(c) Nevertheless, in this instance in terms of the Commission to Investigate Allegations of Bribery or Corruption Act No. 19 of 1994, retired Supreme Court Judges are appointed as Commission Members of the Commission to Investigate Allegations of Bribery or Corruption, with further lucrative allowances and perquisites.

14. (a) In the foregoing circumstances, the Petitioner is advised, that the Arbitral Tribunal ipso facto became improperly constituted and functus, with the appointment of the Chairman of the Arbitral Tribunal, D.J. de Silva Balapatabendi, as the Chairman and Member of the Commission to Investigate Allegations of Bribery or Corruption.

(b) As a consequence, the Arbitral Tribunal ipso facto becoming improperly constituted and functus as aforesaid on or about the said 13th May 2011, thus and thereby the Arbitral Awards made on 20th February 2013 by the said improperly constituted and functus Arbitral Tribunal were ipso facto ab-initio null and void and of no force or avail in law.

(c) The Petitioner ill-advisedly continuing to be a party in such Arbitration Proceedings, did not however or in any manner, whatsoever or howsoever, cure the aforesaid impropriety and the fact that the Arbitral Tribunal ipso facto became functus from around 13th May 2011 as aforesaid.

(d) It was the duty and obligation cast upon the said Chairman of the Arbitral Tribunal, D.J. de Silva Balapatabendi, a retired Supreme Court Judge, to have withdrawn from such Arbitral Tribunal immediately upon assuming Office, as Chairman and Commission Member of the Commission to Investigate Allegations of Bribery or Corruption.

15. (a) It was highly scandalous and of serious odium for the Chairman of the Commission to Investigate Allegations of Bribery or Corruption, exercising executive and quasi-judicial power to investigate and prosecute offences of bribery and corruption, to have involved himself to have chaired private disputes settlements, leaving himself exposed to be compromised by private parties, who make payment for his such services, as Chairman of a private Arbitral Tribunal.

(b) The ‘public perception’, which is vitally important of the independence of the Commission to Investigate Allegations of Bribery or Corruption, in the foregoing circumstances is susceptible to be seriously put in jeopardy.

(c) The foregoing was in serious conflict with the Public Policy of Sri Lanka, warranting the prompt setting aside, as ipso facto ab-initio null and void, the purported Arbitral Awards made on 20th February 2013 by the said improperly constituted and functus Arbitral Tribunal.

(d) Sri Lanka had ratified the UN Convention Against Corruption on 31st March 2004, which encompassed both the public and private sectors, whereby Sri Lanka stands obliged to duly observe, perform and fulfill the duties and obligations on its part under the UN Convention Against Corruption; more so it is imperative on the part of the Commission to Investigate Allegations of Bribery or Corruption to respect and conform to the duties and obligations under the UN Convention Against Corruption.

16. (a) Regardless of the foregoing, the said Arbitral Tribunal, chaired by D.J. de Silva Balapatabendi, Chairman of the Commission to Investigate Allegations of Bribery or Corruption, had continued to conduct Arbitration Proceedings, having previously entertained the Claim of the Respondent dated 31st August 2010.

A certified copy of said Claim dated 31st August 2010 is annexed hereto marked “P12”, pleaded as part and parcel hereof

(b) The Petitioner, as was obliged, responded by the Statement of Defence dated 8th October 2010, including its aforesaid Claim of Rs. 24,045,280/44 made by its aforesaid Letter dated 2nd July 2010 [P9] against the Respondent.

A certified copy of the said Statement of Defence dated 8th October 2010 is annexed hereto marked “P13”, pleaded as part and parcel hereof

18. (a) The aforesaid Arbitral Tribunal as had been notified by Letter dated 4th August 2010 [P11] had commenced Arbitration Proceedings, with the Statement of Claim dated 31st August 2010 [P12] having been tendered, and had proceeded to sit on or about 11 days up to 30th March 2011, at which point of time the Inquiry had commenced with proceedings having been had on two days.

(b) Thereafter, the aforesaid improperly constituted and functus Arbitral Tribunal had regardlessly proceeded to continue to conduct the said Arbitration Proceedings, with the Inquiry being continued on 20th May 2011, after the Chairman of the Arbitral Tribunal, D.J. de Silva Balapatabendi had assumed Office on or about 13th May 2011, as a Member and the Chairman of the Commission to Investigate Allegations of Bribery or Corruption, as aforesaid.

(c) Thus, the improperly constituted and functus Arbitral Tribunal had sat on or about 18 days thereafter conducting the said Inquiry, recording evidence, receiving Written Submissions, hearing Oral Submissions, and consequently had made Awards on 20th February 2013, whilst the Chairman of the Arbitral Tribunal, D.J. de Silva Balapatabendi, was at the very same time, also the Chairman of the Commission to Investigate Allegations of Bribery or Corruption.

Certified copies of a bundle of Documents consisting of all papers filed before the Arbitral Tribunal, including recorded evidence, oral and written submissions, are annexed hereto at the end, compendiously marked “P16”, pleaded as part and parcel hereof

(d) The Petitioner very respectfully reserves the right to tender any further relevant Documents, which would be material to assist Your Honour’s Court to adjudicate upon this matter.

(e) (i) Though the Respondent had held out, more particularly, as per Documents marked

P2 dated 10.5.2007

P3 dated 28.5.2007

P4 dated 28.5.2007

P5 dated 29.2.2008

P6 dated 25.6.2008

P8 dated 10.6.2010

P11 dated 4.8.2010

P12 dated 31.8.2010

that the Respondent was a Public Limited Liability Company without describing itself as a Private Limited Liability Company as mandatorily required in terms of Section 6 of the Companies Act No. 7 of 2007, which came into force on 3.5.2007, the Petitioner in endeavouring to obtain the Annual Accounts of the Respondent from the Registrar of Companies recently discovered that the Respondent was a Private Limited Liability Company, without describing itself correctly, in violation of the said mandatory requirement under Section 6 of the Companies Act No. 7 of 2007.

(ii) In the circumstances, the Petitioner having been unable to obtain copies of Annual Accounts of the Respondent, respectfully moves for an Order of Your Honour’s Court that the Petitioner be permitted to obtain copies of same from the Registrar of Companies and to tender the same to Your Honour’s Court for the proper adjudication of this matter.

(f) On the other hand, the Petitioner had correctly described itself as mandated, as a Private Limited Company under and in terms of Section 6 of the Companies Act No. 7 of 2007

18. (a) The Chairman of the Arbitral Tribunal, D.J. de Silva Balapatabendi, who was also the Chairman of the Commission to Investigate Allegations of Bribery or Corruption, with the Respondent’s Arbitrator, Dudley Karunaratne agreeing, had made a phenomenal baseless Award in favour of the Respondent, tantamounting to conjecture, without having taken any cognizance of the past actual financials of the Respondent, and amounting in total to Rs. 145.5 Mn., (Rs. 55.5 Mn., + Rs. 90 Mn.), having also questionably ignored the interest payable by the Respondent on the substantial aforesaid Loans amounting to Rs. 23,950,000/-, which had been advanced to the Respondent by the Petitioner, as per the aforesaid Agreement [P3], read with joint Letter dated 25th June 2008 [P6], as morefully set out hereinbelow.

(i) A Royalty payment of Rs. 1.5 Mn., per month from the date of Agreement [P3] of 28th May 2007 up to the date of termination of the Agreement [P3] on 30th June 2010 i.e. for 37 months, totaling Rs. 55.5 Mn., less the 3 Loans advanced of Rs. 3.95 Mn., referred to at paragraph 8 hereinbefore; without having taken into account the interest of 19% p.a. payable on such Loans as set out hereinbefore, and also intriguingly having chosen to ignore that the Respondent and Petitioner had, in fact, agreed by Letter dated 25th June 2008 [P6], to amend the said Agreement [P3] dated 28th May 2007 and that the Respondent had confirmed having owed monies to the Petitioner as at 30th June 2008, as set out at paragraph 8 hereinbefore.

(ii) In addition to the above, a further payment of damages purportedly based on the Royalty payments lost by the Respondent of Rs. 1.5 Mn., per month for another future 5 years i.e. for 60 months, making a total of Rs. 90 Mn., from which the aforesaid original Loan of Rs. 20 Mn., paid in May 2007 upon signing of Agreement [P3] had been deducted, that too, questionably without having taken into account the interest payable of 19% p.a. on such Loan as morefully set out hereinbefore; and furthermore without having examined the Respondent’s actual financials for a relevant period before the Petitioner entered into Agreement [P3] in May 2007 with the Respondent, and without having taken cognizance of the cogent fact that the Agreement [P3] stood amended by the joint Letter dated 25th June 2008 [P6].

(iii) Intriguingly, the foregoing interest payable of 19% p.a. had been omitted, notwithstanding the fact that the Petitioner’s Arbitrator, Kushan D’ Alwis in his dissenting Award had provided for such 19% p.a. interest payable by the Respondent to the Petitioner on the aforesaid Loans, which therefore the Chairman of the Arbitral Tribunal, D.J. de Silva Balapatabendi, and Respondent’s Arbitrator, Dudley Karunaratne would have been well and truly aware of.

(b) On the other hand, the Petitioner’s Arbitrator, Kushan D’ Alwis, Attorney-at-Law, dissenting with the foregoing phenomenal Award based on conjecture, had written a separate Order, awarding the Respondent in contrast Rs. 6.04 Mn.; that too, without having taken cognizance of the cogent fact that Agreement [P3] stood amended by the joint Letter dated 25th June 2008 [P6] and that the Respondent had thereby confirmed that the Respondent owed monies to the Petitioner as at 30th June 2008.

Certified copies of the aforesaid Award and the said dissenting Award are annexed hereto marked “P14(a)” and “P14(b)”, respectively,

together with Letter dated 4th April 2013 of Dissanayake Amaratunga Associates, Attorneys-at-Law annexed hereto marked “P15” confirming that they had not received Certified Copies of the aforesaid Awards dated 20th February 2013, even though the Proceedings before the Arbitral Tribunal of 20th February 2013 – vide [P16] had recorded thus in contravention of Section 25 (4) of Arbitration Act No. 11 of 1995

“The Registrar of the Arbitration Centre is directed to send certified copies of the Award and the Dissenting Order to the parties concerned by the registered post”

pleaded as part and parcel hereof

(c) (i) The Agreement [P3] dated 28th May 2007 in proviso at Clause 6(6) had specifically stipulated thus, which was applicable in this instant case:

Provided if the Agreement is so terminated before the expiry of a period of Five years from the date hereof YCC shall refund all monies remaining in its hands out of the said sum of Rs.20,000,000/- to Delmege.”

(ii) The Petitioner in its Statement of Defence [P13] dated 8th October 2010 had stated its Claim of Rs. 24,045,280/44 as had been demanded by its Letter dated 2nd July 2010 [P9] from the Respondent, with the Respondent having given the Petitioner a Promissory Note dated 28th May 2007 [P4].

(iii) Clause 2 (4) of the Agreement [P3] dated 28th May 2007 is given below:

“2(4) within a time period of five (05) years of signing this Agreement, agrees to sell outright and absolutely assign the Brand Name to Delmege in due form of Law for the price or consideration of United States Dollars Two Million (Rs. 2,000,000/-), if Delmege has notified YCC in writing of its intention to so purchase the Brand Name such notice to reach YCC at least fourteen (14) days prior to the intended date of purchase, it being declared and understood that if such notice is not received by YCC as aforesaid, YCC shall have the right to refuse to so sell the Brand Name to Delmege.”

The foregoing is in contravention of the Exchange Control Act, thereby raising the issue that Agreement [P3] is an illegal contract, and thus and thereby would be repugnant of and in conflict with Public Policy.

19. Being aggrieved with the said purported Arbitral Awards made on 20th February 2013 by the aforesaid improperly constituted and functus Arbitral Tribunal, the Petitioner very respectfully invokes the jurisdiction of Your Honour’s Court, and moves to have the said purported Arbitral Awards set aside, on the following, among other grounds, that may be urged by the Counsel for the Petitioner at the Hearing of this Application.

(a) The Chairman of the Arbitral Tribunal, D.J. de Silva Balapatabendi became disqualified from being a Member of the Arbitral Tribunal and Chairman thereof, upon assuming the public office of a quasi-judicial nature on or about 13th May 2011, as a Member and Chairman of the Commission to Investigate Allegations of Bribery or Corruption, thereby ipso facto disqualifying him to have continuing to be a Chairman of the Arbitral Tribunal.

(b) Thus and thereby on or about 13th May 2011 the foregoing rendered the Arbitral Tribunal to ipso facto become improperly constituted and functus, and whereby the aforesaid Awards made on 20th February 2013 to be ab-initio, null and void and of no force or avail in law.

(c) The foregoing Arbitral Proceedings, including the aforesaid purported Arbitral Awards are thus and thereby scandalous and in serious conflict with the Public Policy of Sri Lanka, causing grave public odium.

(d) The purported Awards are contrary to the covenants in the Agreement [P3], dated 28th May 2007, read together with the joint Letter dated 28th June 2008 [P6] between the Respondent and the Petitioner.

(e) The foregoing purported Awards are contrary to the Laws of Sri Lanka and are in conflict with Public Policy of Sri Lanka.

(f) The said purported Awards contain decisions on matters not falling within the purview of the Terms of Reference.

(g) The said purported Awards deal with disputes not contemplated by and not falling within the submissions to Arbitration and also contain matters beyond the scope of submission to Arbitration.

(h) The foregoing purported Awards had been made in the absence of and without any examination of the actual financials of the Respondent.

(i) The foregoing purported Awards had gravely failed to take cognizance of the fact that the Agreement [P3], which stood amended as aforesaid and the consequent arrangements tantamounted to an ‘unfair contract’.

20. (a) If the interim relief sought for herein is not granted, irreparable loss and damage and irremediable mischief would be caused to the Petitioner.

(b) The Petitioner reserves the right to support for interim relief at an appropriate stage.

21. The Petitioner has not previously invoked the jurisdiction of Your Honour’s Court in respect of this matter.

22. The Affidavit of the Group Managing Director of Delmege Forsyth & Co. Ltd., with which Company, Delmege Distributors (Pvt) Ltd., is now amalgamated, is annexed hereto in support of the averments herein contained.

WHEREFORE the Petitioner very respectfully prays that Your Honour’s Court be pleased to:

(a) set aside the Arbitral Awards delivered on 20th February 2013,

(b) grant interim relief staying the operation and enforcement of the Arbitral Awards delivered on 20th February 2013, until the hearing and final determination of this Application,

(c) make an Order declaring that the Petitioner is entitled to obtain certified copies of the Annual Accounts of the Respondent from the Registrar of Companies to be tendered to Your Honour’s Court for the adjudication of this matter

(d) grant costs, and

(e) grant such other and further reliefs as Your Honour’s Court shall seem meet

Settled by:

Viran Corea, Attorney-at-Law

M.A. Sumanthiran, Attorney-at-Law